Securing a business loan often hinges on demonstrating a healthy and predictable cash flow. Lenders need reassurance that your business can comfortably repay the loan, and a well-structured cash flow forecast is the key to proving this. This comprehensive guide will walk you through the essential steps of creating a compelling cash flow forecast that will impress potential lenders and significantly increase your chances of loan approval. We’ll cover everything from identifying your revenue streams and expenses to projecting future cash inflows and outflows, ultimately providing you with a realistic financial picture of your business.

Understanding how to build a robust cash flow forecast is crucial not only for securing a business loan but also for the overall financial health of your company. By accurately projecting your cash position, you can proactively manage your finances, identify potential shortfalls, and make informed decisions regarding investments, expenses, and growth opportunities. This guide will equip you with the necessary tools and knowledge to build a forecast that instills confidence in lenders and positions your business for financial success, regardless of whether you’re seeking funding or simply striving for better financial planning.

Why Cash Flow Forecasting Matters

Cash flow forecasting is paramount when seeking a business loan. Lenders rely heavily on these forecasts to assess the financial health and viability of your business. A well-constructed forecast demonstrates your understanding of your business’s finances and your ability to manage its cash flow effectively.

A strong cash flow forecast showcases your ability to meet your financial obligations, including loan repayments. It provides lenders with confidence in your ability to repay the loan, significantly increasing your chances of approval. Conversely, a weak or missing forecast can raise red flags, suggesting a lack of financial planning and potentially leading to loan rejection.

Beyond securing a loan, a cash flow forecast is a crucial management tool. It allows you to proactively identify potential shortfalls and surpluses in your cash flow, enabling you to make informed decisions about spending, investment, and resource allocation. This proactive approach minimizes financial risks and maximizes opportunities for growth.

Furthermore, a detailed cash flow forecast provides a clear picture of your business’s financial performance over time. This allows you to track progress against projections and make necessary adjustments to your business strategy as needed. It’s an invaluable tool for both short-term and long-term planning, enhancing your ability to navigate market changes and unforeseen challenges.

In short, a well-prepared cash flow forecast is not just a requirement for loan applications; it is an essential component of sound financial management, contributing significantly to the success and sustainability of your business.

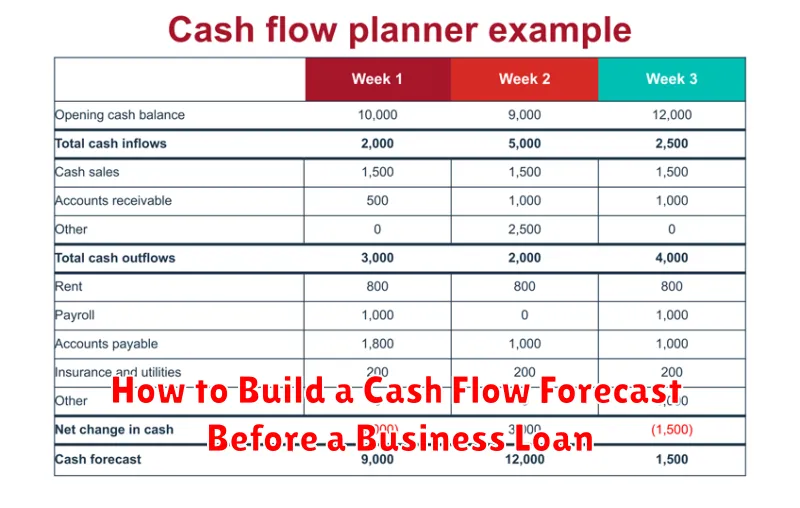

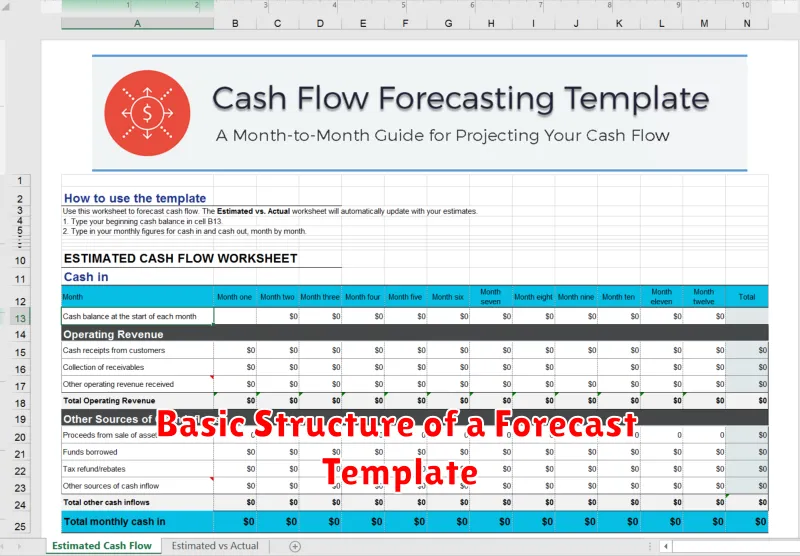

Basic Structure of a Forecast Template

A well-structured cash flow forecast template is crucial for obtaining a business loan. It provides lenders with a clear picture of your company’s financial health and future projections. A basic template generally includes several key sections.

The first section focuses on revenue projections. This involves forecasting your expected income over the forecast period, typically 12-24 months. You should detail the sources of your revenue, such as sales of goods or services, and justify your projections with realistic assumptions based on market research, sales history, and anticipated growth.

Next, the template needs to outline your projected expenses. This section meticulously details all anticipated costs, including cost of goods sold (COGS), operating expenses (rent, salaries, utilities, etc.), and any planned capital expenditures (equipment purchases, renovations). Accuracy in this section is critical, as underestimated expenses can negatively impact the forecast’s reliability.

Following the revenue and expense projections, the template should calculate the net cash flow. This is the difference between your projected revenue and expenses for each period. A positive net cash flow indicates that your business is generating more cash than it’s spending, while a negative net cash flow signifies the opposite. This is a key indicator for lenders evaluating your loan application.

Finally, the template should include a beginning cash balance and calculate the ending cash balance for each period. The beginning cash balance for a given period is the ending cash balance from the previous period. The ending cash balance is calculated by adding the beginning cash balance to the net cash flow for that period. This provides a running total of your available cash throughout the forecast period, highlighting any potential shortfalls or surpluses.

Remember, a well-constructed forecast template is more than just numbers; it’s a narrative that supports your loan application. Clear explanations for your assumptions, supporting data, and realistic projections are essential to convince lenders of your business’s viability.

Estimating Income and Operating Costs

Accurately forecasting your business’s income and operating costs is crucial for a convincing cash flow forecast, especially when applying for a business loan. Lenders want to see a realistic picture of your financial health and your ability to repay the loan. Underestimating income or overestimating expenses can significantly weaken your application.

For income estimation, consider historical data if available. Analyze past sales figures to identify trends and seasonality. If you’re a new business, you’ll need to rely on market research, projected sales based on your business plan, and realistic pricing strategies. Be conservative in your projections; it’s better to slightly underestimate your income than overestimate it.

Operating costs require a detailed breakdown of all expenses your business incurs. This includes direct costs like materials, labor, and manufacturing, as well as indirect costs such as rent, utilities, marketing, and administrative expenses. Don’t forget to factor in potential increases in costs due to inflation or changes in the market. Review your previous expenses (if available) and ensure you account for every cost, even small ones.

It’s helpful to categorize your expenses for better organization and analysis. This allows for easier identification of areas where costs might be reduced or controlled. For example, separating marketing costs into online advertising, print advertising, and event sponsorship allows you to analyze the effectiveness of each channel.

Using spreadsheet software can be extremely beneficial in organizing and calculating your income and expense projections. This allows you to easily adjust figures and see the impact on your overall cash flow forecast. The ability to easily manipulate data is particularly valuable for demonstrating different scenarios to the lender.

Factoring in Loan Repayments

Accurately forecasting cash flow before securing a business loan necessitates a thorough understanding of your anticipated loan repayments. This isn’t simply about knowing the total loan amount; it involves precisely calculating your monthly or quarterly repayments based on the loan’s terms.

Determine the loan’s amortization schedule. This schedule details the breakdown of each payment, showing how much goes towards principal and how much towards interest. This information is crucial for projecting your cash outflow accurately. Most lenders will provide this schedule, either as part of the loan agreement or upon request.

Include all loan-related fees. Beyond the principal and interest, factor in any associated fees such as origination fees, closing costs, or prepayment penalties. These can significantly impact your overall repayment burden and should be incorporated into your cash flow forecast for a realistic picture of your financial obligations.

Consider the loan’s interest rate. A higher interest rate translates to larger repayments and a greater cash outflow. Carefully analyze the interest rate offered and its impact on your overall budget. Incorporate this into your calculations to avoid underestimating your expenses.

Account for potential variations. While the amortization schedule provides a clear picture, unexpected circumstances might necessitate adjustments. For instance, consider the possibility of refinancing or prepaying the loan, potentially altering your cash flow projections. Allow for flexibility in your forecast to accommodate such unforeseen events.

Integrate loan repayments into your monthly and annual projections. This ensures a comprehensive cash flow forecast that accounts for all sources of income and expenditures. This step is essential for demonstrating to lenders your ability to manage the loan responsibly and maintain a healthy cash position.

Using Forecasts to Support Loan Applications

A well-structured cash flow forecast is a crucial component of a successful business loan application. Lenders rely heavily on these forecasts to assess the viability and repayment capacity of your business. It demonstrates your understanding of your business’s financial health and your ability to manage it effectively.

Your forecast should clearly show how you plan to use the loan funds and how you will repay the loan. This involves providing detailed projections of your future income and expenses. It needs to be realistic, based on sound assumptions, and supported by historical data where possible. Simply stating you will repay the loan is insufficient; a lender needs verifiable evidence of your ability to do so.

Key elements to include in your forecast for loan application purposes include: a clear explanation of your business model, detailed revenue projections, comprehensive expense budgets, and a realistic schedule for loan repayment. Ensure that your assumptions are clearly stated and justified. For instance, if you project increased sales, explain the strategies you will implement to achieve this growth.

Remember to present your forecast in a clear and concise manner. Use charts and graphs to visually represent your data where appropriate. This makes it easier for the lender to understand your financial position and prospects. A poorly presented forecast, even if accurate, can detract from your application.

Finally, be prepared to defend your forecast. Lenders will likely ask you questions about your assumptions and projections. Having a thorough understanding of your forecast and being able to justify your numbers will significantly increase your chances of loan approval. Showing that you’ve considered potential risks and have contingency plans in place will also strengthen your application.

Updating Forecasts Monthly to Stay on Track

Regularly updating your cash flow forecast is crucial for maintaining financial accuracy and securing a business loan. A monthly review allows you to identify potential issues early on and make necessary adjustments to your financial plan.

By updating your forecast monthly, you’ll gain a much clearer picture of your actual cash inflows and outflows compared to your projections. This helps in making informed decisions about spending, investments, and potential adjustments to your loan application, if needed. Discrepancies between the forecast and reality become immediately apparent, providing an opportunity for proactive intervention rather than reactive problem-solving.

The process of updating your forecast shouldn’t be overly complex. Focus on key revenue streams and significant expenses. Compare your actual numbers against your projected figures. Analyze any significant variances. This process should inform your next month’s forecast, helping you refine your projections and improve their accuracy over time. Documenting these updates provides a valuable audit trail for lenders to review.

Maintaining an updated forecast showcases your proactive approach to financial management. This demonstrates to potential lenders your commitment to responsible financial planning and increases your credibility as a borrower. It also allows you to confidently address any questions or concerns they may have regarding your financial projections.

In short, monthly updates to your cash flow forecast are not merely a good practice; they are essential for securing a business loan and maintaining the health of your business. It provides continuous monitoring, allowing you to adapt to unforeseen circumstances and ensuring a strong financial foundation.