Are you considering buying a home but unsure about which mortgage type best suits your financial situation? Understanding the intricacies of different mortgage options is crucial for making an informed decision. This article focuses on adjustable-rate mortgages (ARMs), providing a comprehensive overview to help you determine if an ARM is the right choice for you. We’ll delve into the mechanics of ARMs, including how interest rates fluctuate, the impact of index rates and margins, and the various types of ARMs available, such as 3/1, 5/1, 7/1, and 10/1 ARMs.

Navigating the world of home financing can be daunting, especially when faced with complex terminology like initial interest rate, adjustment period, and interest rate caps. This guide aims to demystify adjustable-rate mortgages by explaining these key concepts in a clear and concise manner. Whether you’re a first-time homebuyer or a seasoned investor, understanding the risks and rewards associated with ARMs is paramount before committing to such a significant financial obligation. We will equip you with the knowledge to assess whether an ARM’s potential for lower initial payments aligns with your long-term financial goals.

What Is an Adjustable-Rate Mortgage?

An adjustable-rate mortgage (ARM) is a home loan where the interest rate isn’t fixed for the life of the loan. Unlike a fixed-rate mortgage, where your monthly payment remains consistent, an ARM’s interest rate fluctuates based on an underlying economic index, typically the index rate.

This fluctuating interest rate directly impacts your monthly mortgage payment. When the index rate rises, your payment will generally increase; conversely, when the index rate falls, your payment may decrease. The initial interest rate offered for an ARM, often a lower rate than a comparable fixed-rate mortgage, is known as the teaser rate. This low introductory rate usually lasts for a predetermined period, such as six months or a year, known as the initial adjustment period.

The frequency of subsequent interest rate adjustments is outlined in the loan agreement. Common adjustment periods include one year, three years, or even five years. The amount by which the interest rate can change each time it adjusts is often capped, either by a per-adjustment cap (limiting the increase or decrease in a single adjustment period) or an overall cap (limiting the total increase over the life of the loan).

Understanding the terms and conditions of an ARM is crucial before committing to this type of loan. Factors such as the index used, the margin added to the index, the adjustment periods, and any applicable caps will all affect the long-term cost of your mortgage. It’s essential to carefully consider your financial situation and risk tolerance before opting for an ARM.

Introductory Period vs Adjustment Phase

Understanding the difference between the introductory period and the adjustment phase is crucial when considering an Adjustable-Rate Mortgage (ARM). These two periods represent distinct stages in the life of an ARM loan, each characterized by different interest rate calculations and potential financial implications for the borrower.

The introductory period, often referred to as the initial fixed-rate period or teaser rate period, is the initial timeframe of the loan during which the interest rate remains fixed. This period provides a degree of predictability for the borrower, allowing them to budget based on a consistent monthly payment. The length of this introductory period varies depending on the specific ARM, ranging from a few months to several years. It’s important to note that the interest rate during the introductory period is typically lower than what it will become during the adjustment phase.

Following the introductory period comes the adjustment phase. During this phase, the interest rate is no longer fixed and will adjust periodically, usually on an annual basis. These adjustments are typically based on an index, such as the LIBOR or the Secured Overnight Financing Rate (SOFR), plus a margin, which is a fixed percentage added to the index. The index reflects changes in prevailing market interest rates, while the margin remains constant throughout the loan’s life. The frequency of adjustments, the index used, and the margin are all clearly stated in the loan documents.

The adjustment phase can introduce significant uncertainty into a borrower’s monthly payment. If market interest rates rise, the borrower’s monthly payment will increase accordingly. Conversely, if interest rates fall, the monthly payment may decrease. Understanding the potential for both increases and decreases in the interest rate and subsequently the monthly payment is vital for responsible financial planning. Careful consideration of potential interest rate fluctuations and their impact on affordability is essential during the adjustment phase.

How Rate Adjustments Are Calculated

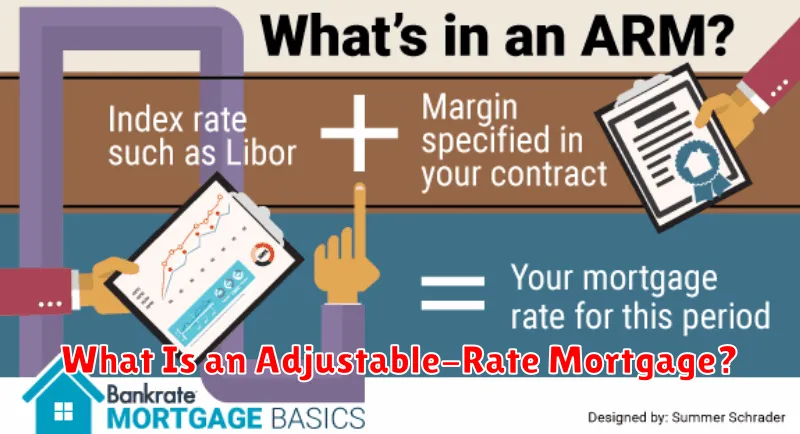

Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate over the life of the loan. These adjustments are typically tied to an underlying index, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR), plus a margin set by the lender.

The calculation is straightforward: the lender adds the margin to the current value of the index. This sum becomes the new interest rate for the adjustment period. For example, if the index is 3% and the margin is 2%, the new interest rate will be 5%.

The frequency of adjustments varies depending on the specific ARM. Some ARMs adjust annually, while others adjust every six months or even monthly. The loan agreement will clearly specify the adjustment frequency and the index used.

It is important to understand that the index is an external factor beyond the lender’s control. Fluctuations in the index will directly impact the borrower’s interest rate and monthly payments. While the margin remains constant for the duration of the loan, changes in the index lead to changes in the overall interest rate.

Many ARMs also include rate caps to limit how much the interest rate can change at each adjustment period and over the life of the loan. These caps provide some protection to borrowers against potentially dramatic rate increases. These caps are usually expressed as a percentage point increase or decrease per adjustment period and a lifetime cap. It’s crucial to review these caps when considering an ARM.

Finally, note that the initial interest rate offered on an ARM is often lower than that of a fixed-rate mortgage. This initial rate, also known as the teaser rate, typically applies for a set period (e.g., the first year or five years). After this period, the interest rate will adjust based on the index and margin calculation described above.

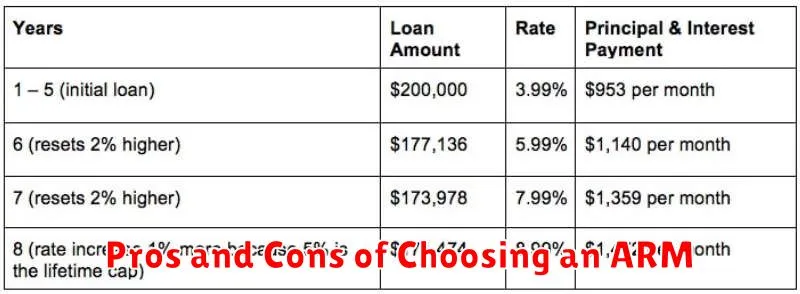

Pros and Cons of Choosing an ARM

Adjustable-Rate Mortgages (ARMs) offer a unique set of advantages and disadvantages compared to traditional fixed-rate mortgages. Understanding these is crucial to making an informed decision about your home financing.

One of the primary pros of choosing an ARM is the typically lower initial interest rate. This can result in lower monthly payments during the initial period, often the first 5-7 years, making them attractive to borrowers with a shorter-term time horizon or those anticipating significant income growth. This lower initial rate can also allow borrowers to qualify for a larger loan amount.

However, a significant con is the uncertainty of future interest rates. After the initial fixed-rate period, the interest rate on an ARM adjusts periodically, usually annually, based on a benchmark index like the LIBOR or SOFR. This means your monthly payments can increase substantially if interest rates rise. This unpredictability can make budgeting difficult and create financial strain if the adjustments are unfavorable.

Another pro is the potential for long-term savings if interest rates remain low or decrease throughout the life of the loan. While the initial rate is lower, if rates stay low, you may pay less interest overall than with a fixed-rate mortgage. However, this is entirely dependent on market conditions, which are inherently unpredictable.

Conversely, a major con is the risk of negative amortization. In some ARM structures, if the interest rate adjustment exceeds the increase in your payment, the unpaid interest is added to your principal balance. This increases the total amount you owe and can lead to a larger overall cost, even if interest rates eventually fall.

In summary, the decision of whether or not to choose an ARM involves carefully weighing the potential for lower initial payments and long-term savings against the significant risk of unpredictable interest rate increases and potential negative amortization. Careful consideration of your financial situation, risk tolerance, and long-term goals is paramount.

Who Should Consider an ARM?

Adjustable-rate mortgages (ARMs) can be a complex financial product, and determining whether one is right for you requires careful consideration of your individual circumstances and financial goals. Several factors should be weighed before opting for an ARM over a traditional fixed-rate mortgage.

Short-term financial goals are a key factor. If you plan to sell or refinance your home within a relatively short timeframe—typically less than 5 to 7 years—an ARM might make sense. During this period, you could benefit from potentially lower initial interest rates compared to a fixed-rate mortgage, saving you money on monthly payments initially. However, it’s crucial to understand that this advantage can quickly disappear if interest rates rise significantly.

Risk tolerance is another crucial element. ARMs carry inherent interest rate risk. If rates increase, your monthly payments will rise, potentially impacting your budget. Those with a high tolerance for risk and the ability to absorb potential payment increases may find ARMs more appealing. Conversely, risk-averse borrowers are generally better suited to fixed-rate mortgages, providing predictable monthly payments regardless of interest rate fluctuations.

Financial flexibility is also vital. To successfully navigate an ARM, you need financial flexibility to accommodate potential increases in monthly payments. A stable income stream and emergency funds are essential to mitigate the risk of financial hardship if interest rates rise unexpectedly. Without sufficient financial reserves, an ARM could pose significant challenges.

Market predictions, while not a guarantee, can influence the decision. If economic forecasts suggest that interest rates are likely to remain low or even decrease over the ARM’s initial fixed-rate period, an ARM might seem more attractive. However, accurately predicting future interest rate movements is notoriously difficult, so this factor should be considered cautiously.

How to Prepare for Future Payment Changes

Adjustable-rate mortgages (ARMs) present a unique challenge: fluctuating interest rates and, consequently, variable monthly payments. Understanding how these changes will affect your budget is crucial to avoid financial hardship.

One of the most effective strategies is to create a realistic budget that anticipates potential payment increases. Carefully review your ARM’s terms, including the initial fixed-rate period and the frequency of interest rate adjustments. Use online calculators or consult with a financial advisor to project possible future payments based on various interest rate scenarios.

Building an emergency fund is another critical step. This fund should ideally cover several months’ worth of mortgage payments at the highest projected rate. This safety net provides a buffer against unexpected payment increases and other financial emergencies that might arise.

Regularly monitoring interest rates is essential for staying informed about potential changes. Pay close attention to economic news and reports that might impact interest rate movements. This proactive approach will allow you to anticipate potential payment adjustments and adjust your financial planning accordingly.

Finally, consider exploring refinancing options if your ARM’s interest rate adjusts significantly and becomes unsustainable. Refinancing to a fixed-rate mortgage eliminates the uncertainty of future payment changes, offering long-term financial stability.