Credit card fraud is a pervasive threat in today’s digital age, impacting millions annually. Victims often face significant financial losses, identity theft, and the considerable stress of resolving the issue. This comprehensive guide will equip you with the knowledge and strategies to effectively protect yourself from becoming a victim of credit card fraud. We’ll explore practical steps you can take to safeguard your financial information both online and offline, covering everything from responsible online banking habits to recognizing and reporting suspicious activity. Learning to protect your credit card is crucial in maintaining your financial security and peace of mind.

Understanding the various methods employed by credit card fraudsters is the first step in protecting yourself. This guide will delve into common tactics such as phishing scams, skimming, and data breaches, providing you with the tools to identify and avoid these risks. We will also discuss the importance of regularly monitoring your credit card statements, utilizing fraud alerts and setting up transaction notifications, and knowing your rights as a consumer in case of credit card fraud. By implementing the strategies outlined in this guide, you can significantly reduce your vulnerability and build a strong defense against this prevalent crime. Taking proactive measures to secure your credit card information is an investment in your financial well-being.

Common Ways Credit Card Fraud Happens

Credit card fraud is a pervasive issue, and criminals employ various methods to steal your information and misuse your card. Understanding these methods is the first step in protecting yourself.

One common technique is phishing. This involves deceptive emails, text messages, or websites that mimic legitimate organizations to trick you into revealing your credit card details. These messages often create a sense of urgency, prompting immediate action and preventing careful scrutiny.

Skimming is another prevalent method. This involves using a device to steal your credit card information when you swipe your card at a compromised ATM or point-of-sale terminal. The device surreptitiously copies the information encoded on the magnetic stripe of your card.

Data breaches are a significant concern. When a company’s database is compromised, criminals can gain access to vast amounts of personal information, including credit card numbers, expiration dates, and security codes. This can lead to widespread fraud affecting numerous individuals.

Lost or stolen cards are another vulnerability. If your physical card is lost or stolen, criminals can use it for unauthorized purchases. Similarly, if your card information is written down or stored insecurely, it could fall into the wrong hands.

Malware installed on your computer or mobile device can also compromise your credit card information. Keyloggers, for example, record your keystrokes, including your credit card details when you enter them online. This malware can be installed through malicious downloads or infected websites.

Finally, insider fraud, where employees or individuals with access to credit card information misuse it for personal gain, poses a considerable threat. This type of fraud is often difficult to detect due to the perpetrator’s access to internal systems.

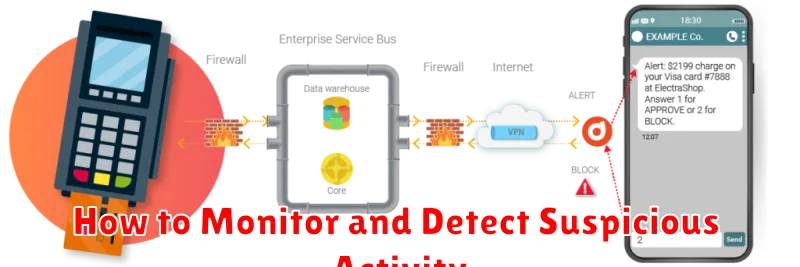

How to Monitor and Detect Suspicious Activity

Regularly monitoring your credit card statements is crucial for detecting suspicious activity. Review your statements online or via paper copies as soon as you receive them. Pay close attention to every transaction, even small ones, to identify any unauthorized purchases.

Look for unusual transaction locations. If you primarily use your card locally, a charge from a distant city or country should raise immediate suspicion. Similarly, be wary of unfamiliar merchant names. Even slightly misspelled names can indicate fraudulent activity.

Pay close attention to transaction amounts. An unusually large purchase, or multiple small purchases totaling a significant amount, could signal a problem. Also, be alert for recurring charges you don’t recognize. These can be a sign of unauthorized subscriptions or services.

Consider using transaction alerts offered by your credit card company. These alerts notify you via text message or email whenever a transaction is made, allowing for immediate detection of any suspicious activity. Many banks also offer mobile apps with detailed transaction histories and notification settings.

Review your credit report periodically for any accounts you don’t recognize. You are entitled to a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Checking your report can reveal accounts opened fraudulently in your name.

Trust your instincts. If a transaction feels wrong, even if you can’t pinpoint exactly why, contact your credit card company immediately. Reporting suspicious activity promptly is critical in mitigating potential losses and preventing further fraudulent activity.

Best Practices for Online and Offline Use

Protecting yourself from credit card fraud requires diligence both online and offline. Vigilance is key to minimizing your risk.

Online, always verify the website’s security before entering any sensitive information. Look for HTTPS in the URL and a padlock icon in your browser’s address bar. Be wary of unsolicited emails or text messages requesting your credit card details. Never use public Wi-Fi for online transactions involving your credit card, as these networks are often vulnerable to hacking. Consider using a virtual credit card for online purchases, providing an extra layer of security.

Offline, safeguard your physical card. Don’t carry more cards than necessary. Report lost or stolen cards immediately. When using your card at a point-of-sale terminal, shield your PIN from onlookers. Be aware of your surroundings and avoid using your credit card in establishments that seem suspicious. Regularly review your credit card statements for any unauthorized transactions. Immediately report any suspicious activity to your bank.

Strong passwords and utilizing multi-factor authentication wherever possible are also crucial steps to protect your online accounts and financial data. Regularly updating your antivirus software and being cautious of phishing scams are essential for a comprehensive approach to credit card security.

By following these best practices, you can significantly reduce your vulnerability to credit card fraud and maintain better control over your financial information. Remember that proactive measures are far more effective than reactive ones when it comes to protecting yourself.

What to Do If You See an Unauthorized Charge

Discovering an unauthorized charge on your credit card can be alarming, but prompt action is crucial to minimizing potential financial damage. The first step is to immediately contact your credit card issuer. They have dedicated fraud departments equipped to handle these situations.

When you call, be prepared to provide specific details about the unauthorized transaction, including the date, amount, and merchant involved. Clearly state that you did not authorize the charge. The issuer will then initiate an investigation.

While the investigation is underway, it’s important to dispute the charge in writing as well. Most issuers provide online portals or mailing addresses for submitting disputes. Maintain copies of all correspondence and documentation related to the fraudulent charge.

Depending on your credit card’s terms and conditions, you may have zero liability for unauthorized charges. However, promptly reporting the fraudulent activity is essential to protect yourself and ensure that you are not held responsible for any amounts.

Following the resolution of the dispute, monitor your credit card statements closely for any further suspicious activity. Consider setting up fraud alerts or monitoring services offered by your credit card issuer or financial institution to help detect potential fraudulent transactions early on.

Remember, acting quickly and decisively is paramount. Don’t hesitate to contact your credit card company as soon as you notice any suspicious or unauthorized transactions. Your prompt response will significantly aid in protecting your financial well-being.

Understanding Your Liability Rights

When it comes to credit card fraud, understanding your liability rights is crucial. Federal law, specifically the Fair Credit Billing Act (FCBA), limits your liability for unauthorized charges.

Under the FCBA, you are generally only liable for a maximum of $50 in fraudulent charges if you report them promptly. This means that if someone uses your card without your permission, you’re not responsible for the entire balance.

However, your liability could be higher under certain circumstances. For instance, if you fail to report the fraudulent activity within a reasonable timeframe (usually within two months of receiving your statement), you might be held responsible for a larger amount. The specific timeframe may vary slightly depending on your card issuer’s policies.

It’s also important to note that reporting the fraud quickly is vital. Prompt reporting strengthens your claim and helps minimize any potential financial loss. Contact your credit card company immediately if you suspect fraudulent activity.

Keep in mind that different card issuers might have slightly different policies regarding liability. While the FCBA sets a minimum standard of protection, it is recommended to review your credit card agreement for specific details about your liability limits in case of fraud. This agreement will clearly outline your rights and responsibilities.

Understanding your liability rights is a critical step in protecting yourself from the financial burden of credit card fraud. By acting promptly and being aware of the regulations that protect you, you can significantly reduce your risk.

Using Alerts and Tools for Extra Protection

Beyond regular monitoring, leveraging alerts and security tools provides an extra layer of protection against credit card fraud. These tools offer proactive notifications and enhanced security measures that can significantly reduce your risk.

Many credit card companies offer fraud alerts, which notify you via text message, email, or phone call when suspicious activity is detected on your account. These alerts can include things like unusual purchase amounts, transactions from unfamiliar locations, or multiple transactions in a short period. Activating these alerts is a crucial step in early fraud detection.

Consider using credit monitoring services. These services continuously track your credit reports for signs of fraudulent activity, such as new accounts opened in your name or inquiries from unknown lenders. They often provide alerts and tools to help you dispute fraudulent activity quickly and efficiently. Some services offer identity theft protection as well, a valuable addition to your security arsenal.

Two-factor authentication (2FA) is another powerful tool. When enabled, 2FA requires a second form of verification beyond your password, such as a code sent to your phone or email, before a transaction can be completed. This extra layer significantly increases the difficulty for fraudsters to access your account, even if they obtain your password.

Finally, regularly review your credit card statements for any unauthorized charges. While alerts can provide early warnings, careful examination of your statements remains an essential practice to identify and address potential fraud.