The end of your student loan grace period is a significant financial milestone that requires careful preparation. Understanding your options and proactively planning for repayment is crucial to avoid late payment fees, damaged credit scores, and the overwhelming stress associated with unexpected debt. This comprehensive guide will equip you with the knowledge and tools necessary to navigate this transition successfully and confidently manage your student loan debt. We’ll cover strategies for budgeting, exploring repayment plans, and understanding your rights as a borrower.

Knowing when your grace period ends is the first step. This crucial timeframe allows recent graduates a temporary reprieve from loan repayments, but it’s vital to avoid the pitfalls of complacency. Failing to plan for the inevitable resumption of payments can lead to financial hardship and potentially long-term negative consequences. This article offers practical advice on how to proactively assess your financial situation, create a realistic budget that accommodates your loan payments, and investigate various repayment options to ensure a smooth transition and a path towards debt freedom.

What Is a Grace Period and How Long It Lasts

A grace period is a temporary period after you complete your studies where you are not required to make payments on your student loans. This period offers borrowers a brief reprieve before they must begin repaying their debt. It’s a crucial time to transition from student life to financial independence and prepare for loan repayment.

The length of the grace period varies depending on the type of federal student loan and, in some cases, the lender. For example, most federal Direct Subsidized and Unsubsidized Loans offer a standard six-month grace period after you graduate, leave school, or drop below half-time enrollment. However, it’s important to note that certain circumstances, such as entering a deferment or forbearance program, may extend or alter the grace period. Always consult your loan servicer’s documentation for precise details regarding your specific loan terms.

Private student loans often have different grace periods than federal loans. Some may offer a grace period, while others may not. The length can vary significantly, from zero months to several months. It’s essential to carefully review the terms and conditions of your private student loan agreements to determine the length of your grace period, if one exists.

Understanding the length and specifics of your grace period is critical for effectively managing your student loan debt. Knowing when your grace period ends allows you to proactively prepare for repayment, ensuring a smooth transition and avoiding potential penalties for late payments.

Steps to Take Before Repayments Begin

As your student loan grace period nears its end, proactive planning is crucial to avoid unexpected financial burdens. Understanding your repayment options and developing a robust budget are key first steps. Take time to thoroughly review your loan documents to confirm loan servicer, interest rates, and repayment plan options. This knowledge empowers you to make informed decisions about your repayment strategy.

Next, carefully assess your current financial situation. Create a detailed budget that accounts for all income and expenses, including essential living costs, debt payments (beyond student loans), and discretionary spending. Identify areas where you can reduce expenses to free up funds for your student loan payments. This thorough budgeting process will help you determine the affordability of various repayment plans.

Contact your loan servicer well in advance of your repayment start date. Inquire about available repayment plans, such as income-driven repayment (IDR) or extended repayment options. These plans may adjust your monthly payments based on your income and family size, potentially making repayment more manageable. Explore all your choices to find the best fit for your financial circumstances.

Consider exploring options for consolidation or refinancing your student loans. This can simplify the repayment process by combining multiple loans into a single payment and may even lower your overall interest rate, saving you money in the long run. However, carefully weigh the pros and cons, as refinancing may affect your eligibility for certain federal loan forgiveness programs.

Finally, automate your student loan payments to ensure timely and consistent repayments. Setting up automatic payments prevents late fees and helps establish a positive payment history. This simple yet powerful step minimizes the risk of delinquency and protects your credit score.

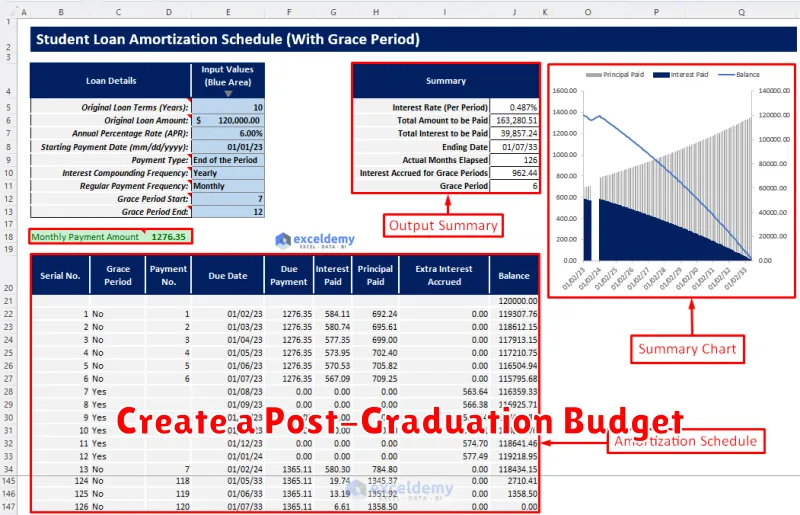

Create a Post-Graduation Budget

The end of your student loan grace period marks a significant financial transition. To navigate this successfully, creating a realistic and detailed post-graduation budget is paramount. This budget should account for all income and expenses, ensuring you can comfortably meet your financial obligations while still saving for the future.

Begin by meticulously listing all sources of income. This includes your salary, any part-time jobs, or potential income from investments or side hustles. Be conservative in your estimates; it’s better to underestimate your income than overestimate it.

Next, meticulously detail your expenses. Categorize them for better tracking and analysis. Essential expenses include housing (rent or mortgage payments), utilities (electricity, water, gas, internet), transportation (car payments, insurance, gas, public transport), food (groceries), and healthcare (insurance premiums, medical bills).

Don’t forget to include less frequent but important expenses such as student loan repayments, insurance premiums (health, car, renter’s), clothing, entertainment, and savings. Allocating a specific amount for savings, even if it’s a small amount, is crucial for building a financial safety net and achieving future goals.

Once you have a comprehensive list of income and expenses, calculate your net income (income minus expenses). If your expenses exceed your income, you’ll need to identify areas where you can reduce spending or explore ways to increase your income. This might involve cutting back on non-essential expenses, seeking a higher-paying job, or finding additional income streams.

Regularly review and adjust your budget. Your financial situation may change over time, so it’s important to adapt your budget to reflect these changes. Tracking your spending using budgeting apps or spreadsheets can provide valuable insights into your spending habits and help you identify areas for improvement.

Creating a detailed post-graduation budget is not just about managing your student loans; it’s about building a strong financial foundation for your future. By carefully planning and monitoring your finances, you can navigate the post-graduation period with confidence and achieve your financial goals.

Choose a Repayment Plan Before First Bill

Before your first student loan payment is due, it’s crucial to select a repayment plan that aligns with your financial circumstances. Failing to do so may result in defaulting on your loan and incurring penalties.

Several repayment plans exist, each with varying terms and conditions. Standard repayment is the most common, requiring fixed monthly payments over a 10-year period. Graduated repayment starts with lower monthly payments that gradually increase over time. Extended repayment stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. These plans typically result in lower monthly payments but could extend the repayment period significantly, leading to higher overall interest costs. It’s important to carefully consider the long-term implications of choosing an IDR plan.

Understanding the pros and cons of each repayment plan is essential for making an informed decision. Factors to consider include your current income, expected future income, financial goals, and risk tolerance. Researching different plans and comparing their features will help you determine which plan best suits your needs.

Contacting your loan servicer is recommended to discuss your options and get personalized guidance. They can provide detailed information about each plan and help you choose the most suitable one based on your individual circumstances. Proactive planning in this area will ensure a smoother transition into repayment and help you avoid potential financial difficulties.

How to Update Contact and Servicer Info

As your student loan grace period approaches its end, ensuring your contact and servicer information is accurate is crucial. Incorrect information can lead to missed payments, late fees, and potential damage to your credit score. Taking proactive steps to verify and update your details will prevent these issues.

First, locate your current student loan servicer. This information should be readily available on your student loan statements or through the National Student Loan Data System (NSLDS). Once you’ve identified your servicer, visit their website. Most servicers provide online portals allowing you to easily update your contact information, including your mailing address, phone number, and email address. This online process is often quick and straightforward, requiring only a few minutes to complete.

If you are unable to update your information online, or prefer a more traditional method, contact your servicer directly via phone or mail. Their contact details will be listed on their website or your loan statements. When contacting them, be prepared to provide necessary identification, such as your Social Security number and loan details. Confirm the updated information with the servicer to ensure accuracy and receive written confirmation if possible.

Regularly reviewing your account information is highly recommended, not just before the end of your grace period. Life changes such as address moves or phone number changes necessitate prompt updates to avoid interruptions in communication from your loan servicer. Proactive management of your contact information ensures smooth repayment and minimizes potential complications.

Remember to maintain accurate information with all your loan servicers, especially if you have multiple loans with different lenders. Failure to do so could lead to serious consequences, impacting your credit rating and increasing the complexity of managing your student loan debt.

When to Consider Starting Payments Early

The end of your student loan grace period can feel daunting, but proactive planning can significantly reduce stress. One strategy to consider is beginning your loan payments early. This isn’t always the best option, but it offers several potential advantages.

A key reason to start payments early is to avoid the shock of a sudden monthly expense. Gradually incorporating loan payments into your budget before the grace period ends allows you to adjust your spending habits and prevents a potentially disruptive financial shift. This is particularly beneficial if you are entering a new job or are unsure about your immediate post-graduation income.

Another significant benefit is the potential to reduce your overall interest payments. Even small payments made early in the grace period will lessen the total amount accrued in interest over the life of your loan. This can lead to substantial savings, especially with high-interest loans. The sooner you begin repayment, the less time interest has to accumulate.

Furthermore, starting early can improve your credit score. Establishing a history of on-time loan payments is crucial for building positive credit. This can be particularly helpful if you plan on making significant purchases or applying for loans in the future. A strong credit history will benefit you financially well beyond your student loans.

However, it’s important to weigh the pros and cons carefully. If you are facing significant financial challenges or uncertainty, delaying payments until the end of the grace period might be a more prudent choice. Prioritizing essential expenses such as housing, food, and transportation is paramount. Assess your financial situation thoroughly before making a decision.

Ultimately, the decision of when to start payments rests on your individual financial circumstances. Careful budgeting and consideration of your short-term and long-term financial goals will help you make an informed choice that best suits your needs.