Are you applying for a home loan and feeling overwhelmed by the process? Understanding what to expect during the home loan underwriting process is crucial for a smooth and successful transaction. This comprehensive guide will walk you through each step, from initial application to final approval, providing insights into the underwriting requirements, documentation needed, and potential challenges you might encounter. We’ll demystify the often-complex world of mortgage underwriting, empowering you to navigate this critical phase with confidence and prepare for a positive outcome.

The home loan underwriting process is a rigorous evaluation of your financial situation to determine your loan eligibility. Lenders meticulously examine your credit score, income, debts, and the property itself to assess your ability to repay the loan. This in-depth review is designed to protect both you and the lender, ensuring a responsible lending practice. This article will equip you with the knowledge to effectively communicate with your lender, proactively address any potential issues, and ultimately increase your chances of securing a favorable mortgage.

What Is Underwriting in Mortgages?

Mortgage underwriting is a crucial step in the home loan process. It’s the comprehensive evaluation of your financial situation and the property you’re hoping to purchase to determine your eligibility for a loan and the terms under which you’ll receive it.

Essentially, the underwriter acts as a risk assessor for the lender. They meticulously examine your credit history, income, debt, and the appraisal of the property to assess the likelihood of you repaying the loan as agreed. This process involves a thorough review of numerous documents and factors.

A key component of underwriting is verifying the information you’ve provided on your loan application. This includes contacting your employers to verify your income, examining your bank statements to assess your financial stability, and pulling your credit report to check your credit score and payment history. The underwriter will also thoroughly review the appraisal report to determine the property’s fair market value.

The outcome of the underwriting process determines whether you’ll be approved for a mortgage, and if so, the terms of the loan, such as the interest rate, loan-to-value ratio (LTV), and any additional conditions that might be imposed. A positive underwriting result signifies that the lender deems you a low-risk borrower.

Understanding the underwriting process is essential for any prospective homebuyer. It’s a detailed and rigorous evaluation, and a strong application, along with clear and accurate documentation, will significantly increase the chances of a favorable outcome.

Documents You’ll Need to Provide

The home loan underwriting process requires a significant amount of documentation to verify your financial stability and the property’s value. Be prepared to provide a comprehensive package of documents to ensure a smooth and timely approval.

Essential Documents typically include, but are not limited to, your two most recent pay stubs, W-2 forms for the past two years, and tax returns for the same period. These documents substantiate your income and employment history. You will also need to provide proof of assets, such as bank statements, investment account statements, and retirement account statements, showing sufficient funds for the down payment and closing costs.

Furthermore, you’ll need to supply details about the property itself. This means providing a copy of the purchase agreement, as well as a home appraisal that verifies the property’s value. Your lender may also request additional documentation pertaining to the property, such as a homeowner’s insurance binder or flood insurance certification, depending on its location and features.

Depending on your specific situation, you may also need to provide other documents, such as proof of homeowner’s insurance, a copy of your driver’s license or other identification, and documentation supporting any gifts or grants received for the down payment. Your loan officer will provide a detailed list of required documents specific to your loan application. It is crucial to gather all necessary documents ahead of time to expedite the underwriting process.

Failure to provide complete and accurate documentation can significantly delay the approval of your home loan. It’s recommended to organize all your documents carefully and maintain clear communication with your lender throughout the process.

What Lenders Evaluate During Underwriting

The underwriting process is a crucial step in obtaining a home loan. During this phase, lenders meticulously assess your financial capabilities to determine your eligibility for a mortgage and the loan terms they’re willing to offer. This involves a comprehensive review of numerous factors.

One primary area of focus is your creditworthiness. Lenders will pull your credit report, examining your credit score, payment history, and outstanding debts. A higher credit score generally indicates lower risk and can result in more favorable loan terms. They’ll scrutinize details like late payments, collections, and bankruptcies, assessing their impact on your overall credit profile.

Beyond credit, lenders delve into your income and employment history. They’ll require proof of income, such as pay stubs or tax returns, to verify your earning capacity. The stability of your employment is also a key factor; a consistent employment history with a reputable employer strengthens your application. They will often calculate your debt-to-income ratio (DTI), comparing your monthly debt payments to your gross monthly income.

Your assets and liabilities are also thoroughly reviewed. Lenders will want to see evidence of your savings and investments, as these demonstrate your financial stability and ability to manage funds. They’ll also consider your existing debts, including mortgages, car loans, and credit card balances, to gauge your overall financial obligations.

Finally, the property itself undergoes evaluation. Lenders will order an appraisal to determine the fair market value of the home you’re purchasing. This appraisal ensures the property’s value justifies the loan amount requested. They may also review the property’s condition and assess potential risks associated with the property.

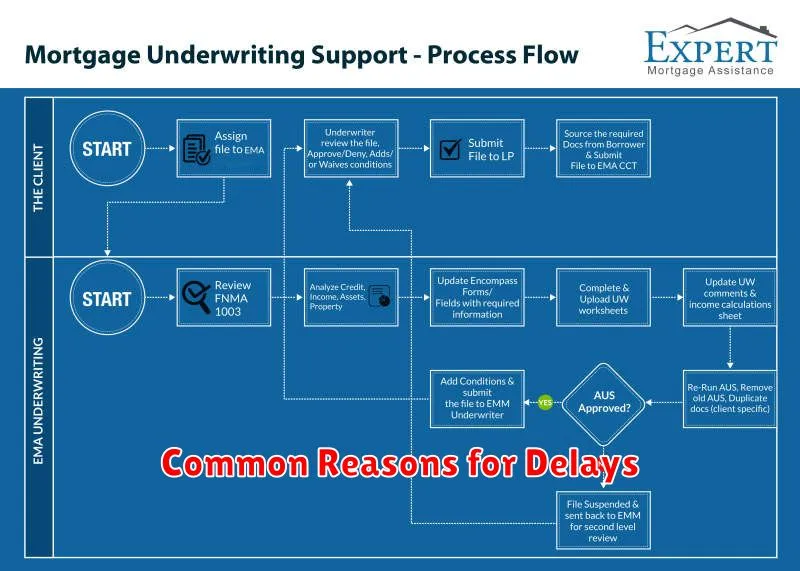

Common Reasons for Delays

The home loan underwriting process, while crucial for securing your mortgage, can sometimes experience delays. Understanding the common causes can help manage expectations and proactively address potential issues.

One frequent cause is incomplete application packages. Underwriters require comprehensive documentation to assess your financial situation and the property’s value. Missing tax returns, pay stubs, or appraisal reports can significantly stall the process. Ensuring all necessary documents are submitted accurately and completely from the outset is vital.

Issues with credit reports also contribute to delays. Discrepancies, inaccuracies, or insufficient credit history can trigger further investigation, adding time to the timeline. Reviewing your credit report for errors before applying and addressing any concerns promptly is recommended.

Appraisal challenges are another potential source of delay. If the appraised value falls below the purchase price, negotiations between the buyer, seller, and lender may be necessary, potentially prolonging the process. A smooth appraisal process requires clear communication and potentially the selection of a reputable and experienced appraiser.

Changes in your financial situation during the underwriting period can also cause delays. Any significant changes, such as a job loss, change in income, or large debt acquisition, will require re-evaluation and updated documentation, delaying the final approval.

Finally, communication breakdowns between the borrower, lender, and other parties involved can lead to unforeseen delays. Prompt responses to requests for information and consistent communication are essential for a smooth and efficient process.

How Long the Process Typically Takes

The home loan underwriting process can vary significantly in length, depending on several factors. These factors include the complexity of your financial situation, the lender’s processing speed, and the type of loan you’re applying for. A straightforward application with a clean financial history might take as little as 15-30 days.

However, more complex situations, such as self-employment, significant debt, or less-than-perfect credit history, could extend the process to 45-60 days or even longer. Delays can also arise from issues encountered during the verification of your documents, appraisals, or title searches. Responding promptly to lender requests for additional information is crucial in minimizing processing time.

It’s important to understand that the underwriting process isn’t a single, linear progression. It often involves multiple steps and reviews, with potential setbacks requiring additional documentation or clarification. Maintaining open communication with your lender throughout the process will allow you to stay informed and address any potential delays proactively.

While the lender will provide an estimated timeframe at the outset, unforeseen circumstances can impact the overall duration. Be prepared for the possibility of a longer-than-anticipated process, and remember that a thorough underwriting process ensures a secure and stable mortgage.

Tips to Ensure a Smooth Review

The home loan underwriting process can seem daunting, but proactive preparation can significantly smooth the review. One of the most crucial steps is to ensure the completeness and accuracy of your application. Gather all necessary documentation beforehand, including pay stubs, tax returns, bank statements, and any other financial records requested by your lender. This meticulous approach minimizes delays caused by missing information.

Maintain open and honest communication with your lender throughout the process. Promptly address any questions or requests for clarification, and don’t hesitate to ask for updates on the progress of your application. A proactive and communicative approach helps to build trust and foster a more efficient review.

Another key factor for a successful review is financial stability. Avoid making any significant financial changes, such as opening new lines of credit or making large purchases, during the underwriting process. Such changes can raise concerns about your financial capacity and potentially delay or even jeopardize your loan approval. Maintaining a consistent financial picture reassures the underwriters.

Finally, carefully review all documents before signing them. Understand the terms and conditions fully to avoid any surprises or potential complications later. Seeking clarification on anything unclear will save time and prevent misunderstandings that could lead to delays.