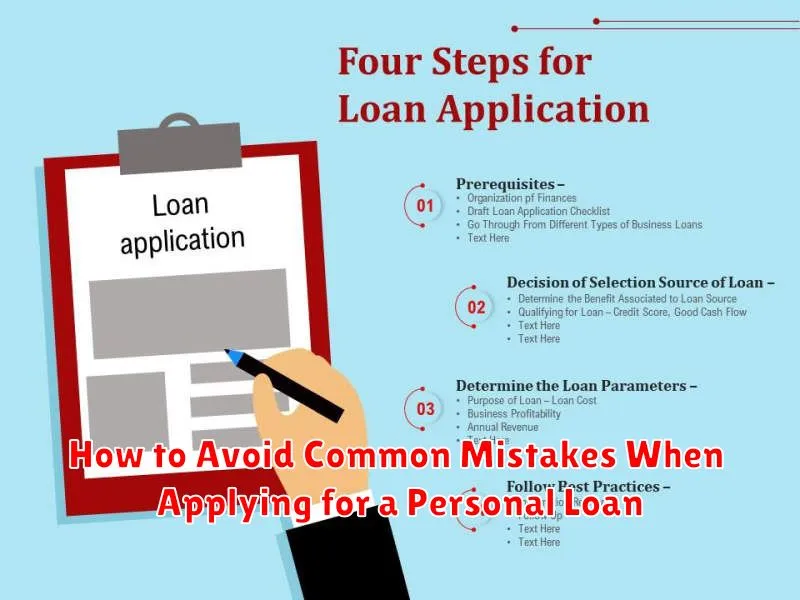

Securing a personal loan can be a crucial step in achieving your financial goals, whether it’s for home improvements, debt consolidation, or unexpected expenses. However, navigating the loan application process without falling prey to common pitfalls can be challenging. This comprehensive guide will equip you with the knowledge to avoid costly mistakes, ensuring a smooth and successful application, maximizing your chances of approval and securing the best possible interest rates. We’ll cover everything from understanding your credit score and choosing the right loan amount to effectively presenting your financial information and negotiating favorable terms.

Many applicants make critical errors that significantly impact their loan application outcome. From overlooking crucial details on the application form to misrepresenting financial information, these mistakes can lead to rejection or unfavorable terms. This article will delve into these common personal loan application mistakes, providing practical solutions and preventative measures. Learning to avoid these pitfalls will empower you to present a strong application, increasing your likelihood of securing the financing you need at a competitive rate and navigate the often complex world of personal loans with confidence.

Not Checking Your Credit Score First

One of the most crucial steps before applying for a personal loan is checking your credit score. Ignoring this fundamental step can significantly impact your chances of approval and the interest rate you’ll receive.

Your credit score is a numerical representation of your creditworthiness, reflecting your history of borrowing and repayment. Lenders use this score to assess the risk associated with lending you money. A higher credit score typically translates to better loan terms, including lower interest rates and more favorable repayment options. Conversely, a low credit score might lead to loan rejection or significantly higher interest rates, potentially making the loan unaffordable.

By checking your credit report and credit score beforehand, you’ll gain valuable insight into your financial standing. You’ll be able to identify any errors that might negatively impact your score and take steps to correct them before applying for a loan. Furthermore, understanding your score allows you to set realistic expectations regarding the loan approval process and the terms you are likely to receive.

Failing to check your credit score is akin to entering a crucial negotiation blindfolded. It significantly increases the risk of encountering unexpected obstacles and potentially jeopardizing your chances of securing a favorable personal loan.

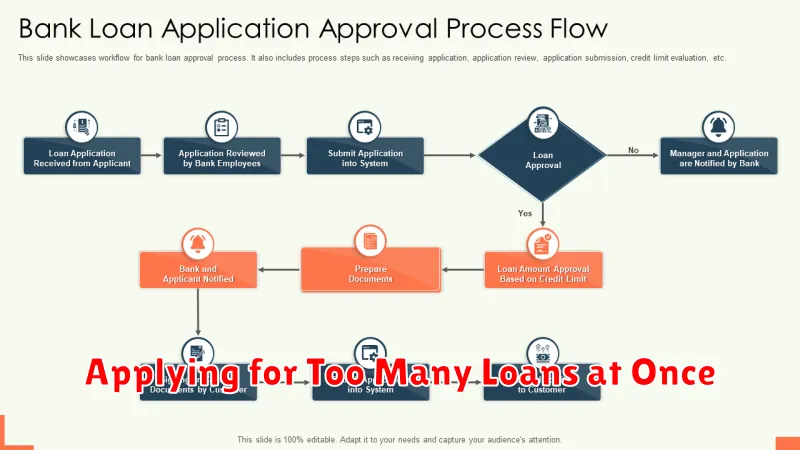

Applying for Too Many Loans at Once

Applying for numerous personal loans simultaneously can significantly harm your credit score. Each loan application results in a hard inquiry on your credit report, which negatively impacts your creditworthiness. Multiple hard inquiries within a short period suggest a high level of financial risk to lenders.

Lenders view numerous applications as a sign of potential financial instability. It implies you may be struggling to manage your existing finances and are relying on multiple loans to cover your expenses. This significantly reduces your chances of loan approval, even if you meet the individual requirements for each loan.

Moreover, the sheer number of applications can overwhelm the loan processing system. It can lead to delays in receiving approval or even rejection, creating further financial strain. It’s crucial to carefully consider your financial needs and research loan options thoroughly before submitting multiple applications.

Instead of applying for several loans at once, focus on selecting a few suitable options and thoroughly researching their terms and conditions. Compare interest rates, fees, and repayment schedules to find the best fit for your financial situation. This strategic approach helps avoid damaging your credit score and increases the likelihood of securing a loan.

Ignoring the Fine Print on Fees and Terms

One of the most significant mistakes borrowers make is overlooking the fine print regarding fees and terms. Many personal loans come with various charges beyond the advertised interest rate. These can include origination fees, prepayment penalties, and late payment fees.

Origination fees are charges levied by the lender to process your loan application. These can be a percentage of the loan amount or a flat fee, and can significantly impact the overall cost of borrowing. Prepayment penalties, on the other hand, punish borrowers for paying off their loan early, often incurring substantial fees. Late payment fees are added when a payment is not made by the due date and can quickly accumulate, adding considerable expense to the loan.

Carefully reviewing the loan agreement to understand all associated fees is crucial. Don’t just focus on the Annual Percentage Rate (APR); it’s essential to understand the total cost of the loan, including all applicable fees. Comparing loans based solely on the APR without considering additional charges can lead to an unexpectedly high total repayment amount.

Furthermore, understanding the terms and conditions beyond fees is essential. This includes understanding the repayment schedule, the loan duration, and any other stipulations outlined in the contract. Ignoring these details could result in unexpected difficulties meeting repayment obligations, leading to further financial complications.

Borrowing More Than You Really Need

One of the most common mistakes people make when applying for a personal loan is borrowing more money than they actually require. While it might seem tempting to take out a larger loan to cover various expenses or have extra funds available, this can lead to several negative consequences.

Firstly, a larger loan means higher monthly payments. This can strain your budget and potentially lead to difficulty making timely repayments. Missed or late payments can significantly damage your credit score, making it harder to secure loans or other forms of credit in the future. Furthermore, you’ll end up paying more in interest over the life of the loan. The interest accrued on a larger loan amount will be substantially greater than on a smaller loan, increasing the overall cost of borrowing.

Before applying for a personal loan, it’s crucial to carefully assess your needs and determine the precise amount of money you require. Create a detailed budget outlining the purpose of the loan and the specific costs involved. This will help you avoid the temptation to borrow excessively and ensure you only borrow the necessary amount. Remember, responsible borrowing involves securing only the funds you truly need for your intended purpose.

Consider exploring alternative options to reduce the need for a large loan. Could you defer certain expenses, save a portion of the needed amount yourself, or explore less expensive alternatives? These actions can reduce the amount you need to borrow and help you manage your debt effectively.

Choosing the Wrong Loan Type

One of the most significant mistakes applicants make is selecting an inappropriate loan type for their needs. Failing to understand the nuances between different loan options can lead to unfavorable terms and financial hardship.

For instance, opting for a secured loan when an unsecured loan would suffice can unnecessarily put your assets at risk. Secured loans, while often offering lower interest rates, require collateral, meaning you could lose a valuable possession if you default. If your financial situation is stable enough to manage repayments without collateral, an unsecured loan may be a more suitable choice.

Conversely, choosing an unsecured loan when you need a larger sum of money could prove problematic. Unsecured loans typically have higher interest rates and lower borrowing limits. If your borrowing requirements exceed the limits of an unsecured loan, you might need to explore alternatives like a secured loan or a different financing option altogether.

Furthermore, the repayment terms are crucial. A short-term loan might offer quick access to funds but come with significantly higher monthly payments. Conversely, a long-term loan may reduce monthly payments but result in paying considerably more interest over the loan’s lifespan. Careful consideration of your financial capabilities and long-term goals is vital when choosing a repayment schedule that fits your circumstances.

Before applying for any personal loan, thorough research into various loan types and their associated terms is essential. Understanding the differences between secured and unsecured loans, the implications of varying interest rates, and the impact of different repayment schedules is key to making an informed decision.

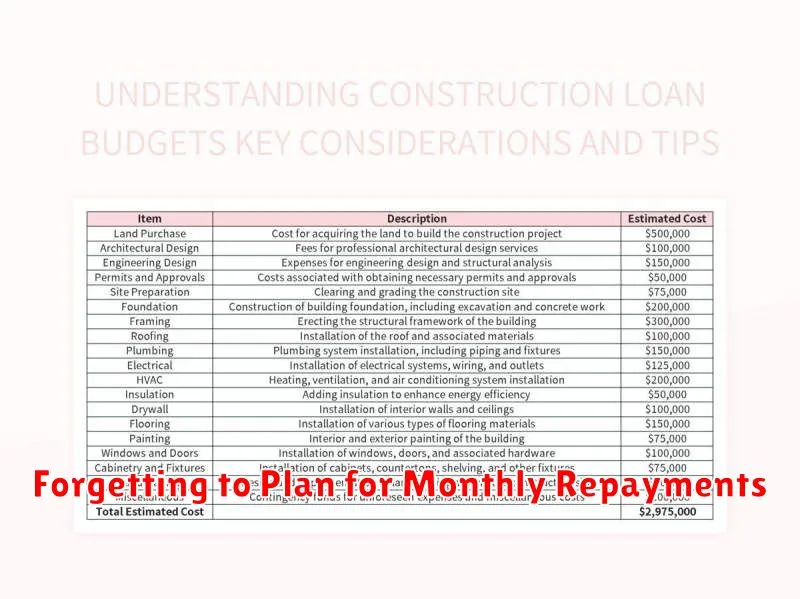

Forgetting to Plan for Monthly Repayments

One of the most significant mistakes applicants make when applying for a personal loan is failing to adequately plan for the monthly repayments. This oversight can lead to severe financial difficulties down the line.

Before applying, it’s crucial to carefully assess your current financial situation. Create a detailed budget outlining your income and expenditures. This will help you determine how much you can comfortably afford to repay each month without jeopardizing your other financial obligations.

Consider using online loan calculators to estimate your monthly payments based on various loan amounts, interest rates, and repayment terms. These tools provide a realistic picture of the financial commitment involved.

Remember that the monthly repayment amount is not the only factor. You also need to account for any other recurring expenses you may have, such as rent, utilities, and groceries. Ensure that your budget can comfortably accommodate the loan repayment without forcing you to cut back on essential spending.

Failing to plan for monthly repayments can result in missed payments, which can negatively impact your credit score and lead to additional fees and penalties. Thorough planning is key to securing a personal loan responsibly and avoiding future financial stress.