Understanding escrow accounts is crucial for anyone involved in a mortgage. This seemingly complex financial tool plays a vital role in ensuring timely payments for property taxes and homeowner’s insurance, ultimately protecting both the lender and the borrower. This article will clearly explain what escrow accounts are, how they function within the mortgage process, and address common questions surrounding their management and implications.

We will delve into the benefits of using an escrow account, including avoiding the risk of missed payments and potential foreclosure. You’ll learn how your monthly mortgage payment is structured to include escrow components, how funds are managed by your lender, and the process for reviewing and understanding your escrow statements. By the end, you’ll have a comprehensive understanding of how escrow accounts contribute to a smooth and secure mortgage experience.

What Is an Escrow Account?

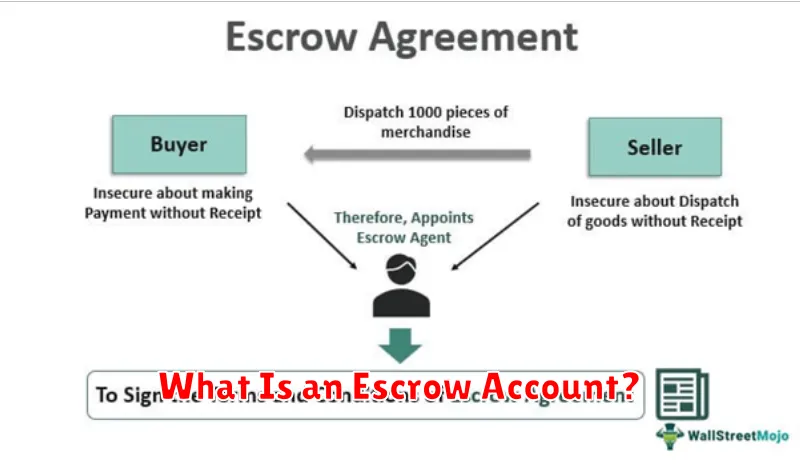

An escrow account, also known as an impound account, is a dedicated bank account held by a third party, typically a mortgage lender or closing agent. It’s used to collect and pay certain housing-related expenses on behalf of a homeowner.

The primary purpose of an escrow account is to ensure timely payment of these essential expenses. This simplifies the mortgage process for borrowers and reduces the risk of missed payments that could lead to late fees or foreclosure. By pooling funds, the lender guarantees funds are available when property taxes and insurance premiums become due.

Common expenses typically included in an escrow account are: property taxes, homeowner’s insurance premiums, and sometimes private mortgage insurance (PMI). The lender will estimate the annual amount of each expense and divide it by 12 to determine the monthly escrow payment. This payment is then added to the borrower’s regular monthly mortgage payment.

It’s important to note that while the lender manages the account, the funds remain the borrower’s property. The lender acts solely as a trustee, disbursing the funds as necessary to cover the designated expenses. Borrowers usually receive an annual statement detailing the account’s activity and balance.

Establishing an escrow account is a common practice for most mortgages. While it might seem like an added cost, it offers significant benefits in terms of managing expenses and protecting the lender’s investment (and, ultimately, the borrower’s home).

Why Lenders Require Escrow

Lenders require escrow accounts as a risk mitigation strategy. By collecting payments for property taxes and homeowner’s insurance premiums in advance, they ensure these essential expenses are covered throughout the life of the loan. This protects both the lender and the homeowner.

Delinquency on property taxes and insurance can severely impact the lender’s security interest in the property. If a homeowner fails to pay these essential bills, the property may be subject to liens or even foreclosure, significantly diminishing the lender’s ability to recoup their investment should the borrower default on the mortgage. Escrow accounts eliminate this risk.

From the lender’s perspective, escrow simplifies the process of managing these payments. Instead of having to track individual payments and ensure timely submissions, the lender receives a consolidated payment directly from the escrow account. This streamlines administrative tasks and reduces the operational burden on the lending institution.

Furthermore, the consistent flow of funds through escrow provides predictability and stability for the lender. Knowing that funds for property taxes and insurance are readily available ensures the lender can promptly address any issues related to these expenses. This predictability is particularly important in managing the overall financial health of the lending portfolio.

Finally, for borrowers, escrow offers the convenience of bundling payments into a single monthly mortgage payment. This simplified payment structure makes budgeting easier and reduces the risk of inadvertently forgetting a crucial payment that could trigger negative consequences.

What Is Included in Escrow Payments

Escrow payments are funds held by a third party, typically a title company or escrow agent, on behalf of the buyer and seller in a real estate transaction. In the context of mortgages, escrow payments encompass several crucial components that ensure timely payment of property-related expenses.

Property Taxes: A significant portion of your escrow payment goes towards paying your annual property taxes. These taxes fund local government services and are typically paid in installments through your escrow account.

Homeowner’s Insurance: Your monthly escrow payment also includes your homeowner’s insurance premium. This insurance protects your property against various risks, such as fire, theft, and liability.

Private Mortgage Insurance (PMI): If your down payment was less than 20% of the home’s purchase price, your lender may require you to pay Private Mortgage Insurance (PMI). This protects the lender in case of default and is often included in your escrow payments.

Homeowner’s Association (HOA) Fees (if applicable): For properties within a homeowner’s association, your escrow payments might include HOA fees. These fees cover the maintenance and upkeep of common areas and amenities within the community.

Flood Insurance (if applicable): In areas prone to flooding, your lender may require flood insurance. The premiums for this insurance are usually included in your escrow payment.

It’s important to note that the specific components of your escrow payment will depend on your individual circumstances and the requirements of your mortgage lender. Regularly reviewing your escrow statements allows you to verify that your payments are being applied correctly.

How Escrow Balances Are Adjusted Annually

Your escrow account balance is reviewed and adjusted annually, typically around the anniversary of your mortgage closing. This process ensures that your payments accurately reflect the current property taxes and homeowner’s insurance premiums.

The adjustment is based on several factors. Your lender will receive updated tax and insurance bills. They’ll compare these amounts to your current escrow payments. If the new bills are higher, your monthly escrow payment will increase to cover the difference over the next year. Conversely, if the new bills are lower, your monthly payment might decrease.

You will receive a detailed statement from your lender explaining the adjustment. This statement will clearly show the prior year’s payments, the current year’s estimated costs, and the calculated adjustment to your monthly mortgage payment. It’s essential to review this statement carefully and contact your lender if you have any questions or discrepancies.

The frequency of adjustments may vary depending on your lender and the specifics of your mortgage agreement. While an annual adjustment is most common, some lenders may perform a semi-annual or even more frequent review.

It’s important to note that significant changes in your property taxes or insurance premiums between annual adjustments can lead to substantial increases or decreases in your escrow payments. For example, major renovations or increases in local property values could result in higher tax assessments, subsequently increasing your escrow payment. It’s crucial to monitor these factors and communicate with your lender if there are any changes.

Can You Waive Escrow? Pros and Cons

Whether you can waive escrow depends entirely on your lender. Many lenders require escrow accounts as a condition of your mortgage, particularly for conventional loans. However, some lenders may allow you to opt out if you meet specific criteria, such as having sufficient funds to cover property taxes and insurance premiums without the need for a payment reserve.

Waiving escrow offers several potential advantages. Most notably, you retain more of your own money, increasing your cash flow. This can be particularly beneficial for individuals or families with tight budgets. Furthermore, you have greater control over your funds and can potentially earn a higher return by investing them elsewhere.

However, there are also significant disadvantages to consider. The primary drawback is the increased responsibility for remembering and paying your property taxes and homeowner’s insurance premiums on time. Failing to do so can result in serious consequences, including late payment fees, liens on your property, and even foreclosure in extreme cases. It also requires strong financial discipline and excellent organization to avoid falling behind on these essential payments.

Furthermore, waiving escrow can lead to unexpected financial burdens. Property taxes and insurance costs can fluctuate, and you’ll need to be prepared for those increases. Unexpected expenses may arise, putting a strain on your personal finances if you haven’t adequately budgeted for these payments. Effectively managing your finances and having a robust emergency fund are crucial if you choose to waive escrow.

Ultimately, the decision of whether to waive escrow is a personal one. Carefully weigh the pros and cons based on your financial situation, risk tolerance, and organizational skills before making a choice. Consulting with a financial advisor can also be beneficial in making an informed decision.

How to Read Your Escrow Statement

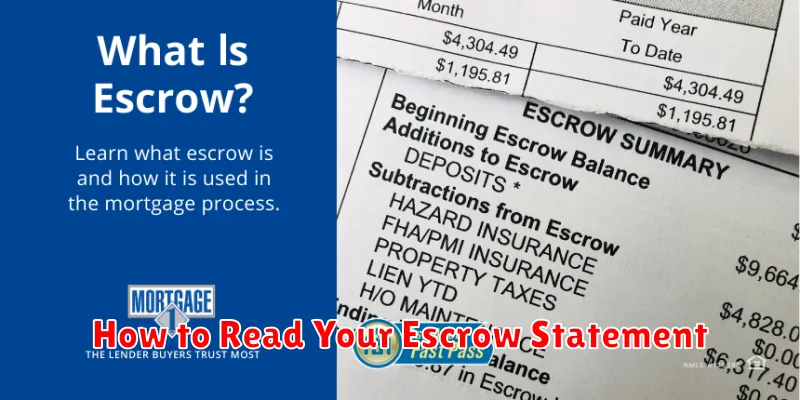

Understanding your escrow statement is crucial for managing your mortgage payments effectively. This statement details the funds your lender holds in your escrow account and how those funds are being used to pay your property taxes and homeowners insurance.

Typically, your statement will begin with a summary showing your account balance at the start of the period. This is followed by a breakdown of payments made during that period, including specific amounts paid towards property taxes and insurance premiums. You’ll also see a record of any deposits made into the account, usually from your monthly mortgage payment.

Look for details on the due dates for your property taxes and homeowners insurance. This helps you track upcoming payments and anticipate any potential increases in your escrow payments. The statement should clearly outline the amount paid for each item and the remaining balance in your escrow account.

Pay close attention to the projected balance at the end of the next payment cycle. This helps you anticipate any adjustments to your monthly mortgage payment that might be necessary to maintain sufficient funds in your escrow account. Large fluctuations in these projections might indicate an unexpected increase in taxes or insurance premiums.

If you notice any discrepancies or have questions about the information presented in your escrow statement, it’s best to contact your lender or mortgage servicer promptly. They can clarify any uncertainties and ensure the accuracy of your account information.