Choosing the right student loan repayment plan can significantly impact your financial future. With various options available, including income-driven repayment (IDR) plans, standard repayment plans, and extended repayment plans, understanding your options is crucial to avoid overwhelming student loan debt. This comprehensive guide will walk you through the key considerations for selecting the best student loan repayment plan that aligns with your individual financial circumstances and long-term goals. We’ll explore the advantages and disadvantages of each plan, helping you make an informed decision and navigate the complexities of student loan repayment.

This article will equip you with the knowledge to effectively manage your student loan debt. We’ll delve into the intricacies of different repayment plans, including loan forgiveness programs and the potential implications of choosing the wrong option. By understanding the nuances of federal student loan repayment and private student loan repayment, you can develop a personalized student loan repayment strategy that minimizes your financial burden and sets you on a path toward financial freedom. Learning how to effectively manage student loan interest and explore options like loan consolidation will also be covered to ensure you make the most informed decision possible.

Overview of Federal Repayment Options

The federal government offers several repayment plans for student loans, each with its own terms and conditions. Choosing the right plan depends on your individual financial situation and your ability to make monthly payments. It’s crucial to understand the nuances of each option before making a decision.

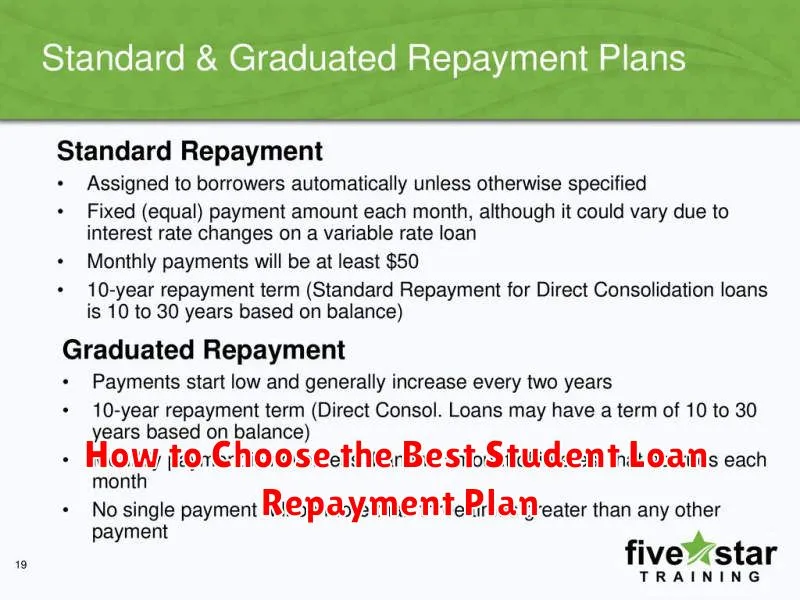

Standard Repayment Plan: This is the default plan, requiring fixed monthly payments over a 10-year period. While straightforward, it may result in higher monthly payments compared to other options.

Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This can be helpful in the early stages of a career when income is typically lower, but payments will become significantly higher later on.

Extended Repayment Plan: This plan stretches payments over a longer period, up to 25 years, resulting in lower monthly payments but higher total interest paid over the life of the loan.

Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your discretionary income and family size. Several IDR plans exist, including the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Driven Repayment (IDR) plans. These plans often lead to loan forgiveness after a certain number of payments, typically 20-25 years, but the forgiven amount is considered taxable income.

Income-Contingent Repayment (ICR) Plan: Similar to IDR plans, ICR plans link your monthly payment to your income and family size. The repayment period is typically 25 years. It is important to note that ICR plans are generally less favorable than other IDR plans in terms of potential forgiveness.

Understanding the pros and cons of each plan is essential for making an informed decision. Factors to consider include your current income, expected future income, and your long-term financial goals. Contacting your loan servicer or a student loan counselor can provide personalized guidance.

Standard vs Income-Based Plans Explained

Choosing the right student loan repayment plan is crucial for managing your debt effectively. Two primary options exist: Standard Repayment Plans and Income-Based Repayment (IBR) Plans. Understanding their differences is key to making an informed decision.

A Standard Repayment Plan is characterized by its fixed monthly payments over a 10-year period. This plan offers the benefit of paying off your loans quickly, resulting in less interest accrued overall. However, the fixed monthly payments can be substantial, potentially straining your budget, especially immediately after graduation.

In contrast, Income-Based Repayment (IBR) Plans offer greater flexibility. These plans calculate your monthly payment based on your discretionary income and family size. This means your payments will be lower if your income is low, making them more manageable during periods of financial instability or career transitions. However, IBR plans typically extend the repayment period to 20 or 25 years, leading to a higher total interest paid over the life of the loan.

The key difference lies in the balance between affordability and repayment speed. Standard plans prioritize speed, while IBR plans prioritize affordability. The best choice depends heavily on your individual financial circumstances, including your post-graduation income projections and risk tolerance.

It’s important to note that several types of IBR plans exist, each with its own specific calculation methods and eligibility requirements. These include IBR, Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Researching these variations is essential to determining which plan best suits your needs.

How Your Career Goals Affect Your Choice

Choosing the right student loan repayment plan is a crucial decision that significantly impacts your financial future. However, it’s not solely a financial calculation; your career aspirations play a vital role in this process.

Your chosen career path directly influences your potential earning power. A high-earning career allows for more aggressive repayment strategies, potentially enabling you to pay off your loans faster through options like accelerated repayment or even refinancing. Conversely, a career with a lower earning potential may necessitate a more conservative approach, perhaps opting for an income-driven repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

Long-term career stability is another key consideration. If you anticipate significant career changes or periods of unemployment, an IDR plan might offer better protection against default. These plans offer more flexibility in times of financial hardship, preventing your credit score from being severely impacted. Conversely, a stable, high-earning career might justify a more aggressive repayment strategy with the potential for higher upfront payments, resulting in less interest paid overall.

Furthermore, the specific demands of your chosen field could influence your repayment plan selection. Certain professions, such as medicine or law, often involve substantial student loan debt. Individuals pursuing these careers might find IDR plans particularly helpful during their residency or fellowship years when income is comparatively lower. Understanding how your chosen career’s financial realities align with different repayment plans is essential for making an informed choice.

Ultimately, aligning your student loan repayment plan with your career goals ensures a sustainable financial path. Carefully considering your earning potential, career stability, and the unique financial aspects of your profession will significantly impact your ability to manage your debt effectively and achieve your career aspirations.

Calculating Monthly Payments in Each Plan

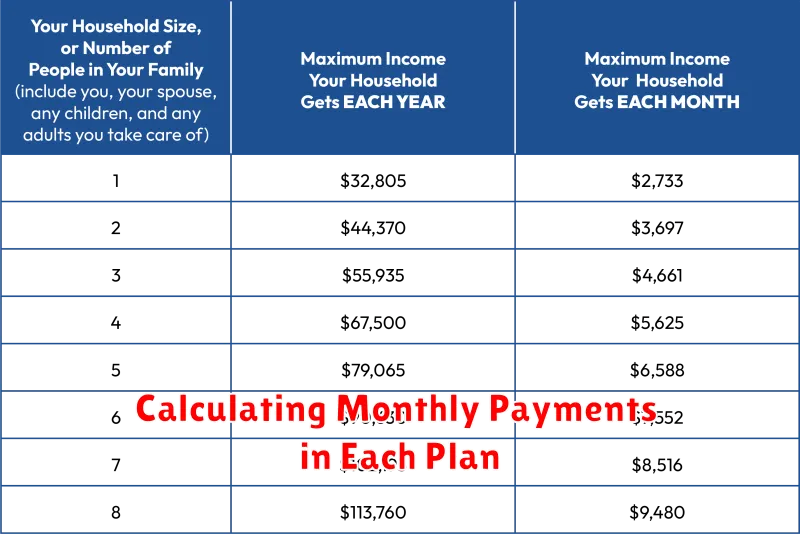

Choosing the best student loan repayment plan requires a careful consideration of your individual financial situation and long-term goals. A crucial element of this decision-making process is understanding how to calculate the monthly payments associated with each available plan. This involves more than just plugging numbers into a formula; it requires understanding the interest rate, loan principal, and repayment period specific to each loan.

The most common repayment plans utilize a method known as amortization. This method breaks down your total loan amount into a series of equal monthly payments, each covering both principal (the original loan amount) and interest accrued over time. The exact amount you’ll pay each month depends on several factors, including the interest rate charged on your loan and the length of your repayment term. Higher interest rates naturally lead to higher monthly payments, and longer repayment terms result in more payments over time, even if each individual payment is smaller. Conversely, shorter repayment periods typically mean larger monthly payments but lower overall interest paid.

Several online student loan calculators are available to assist you in this calculation. These tools allow you to input the relevant details of your student loans – including the principal amount, interest rate, and repayment term – to instantly determine your estimated monthly payment for various repayment plans. Many lenders also provide similar calculators directly on their websites. Carefully input your loan details to obtain accurate estimations for each plan.

It’s vital to note that some repayment plans, such as income-driven repayment (IDR) plans, calculate monthly payments differently. Instead of relying solely on the loan’s principal and interest rate, IDR plans consider your annual income and family size to determine a more manageable monthly payment amount. Therefore, using a generic amortization calculator won’t suffice for accurately determining monthly payments under IDR plans; you’ll need to utilize a calculator specifically designed for these plans, or consult your lender directly.

By systematically comparing the calculated monthly payments across different repayment plans, you can gain a comprehensive understanding of the financial implications of each option and make a well-informed decision aligned with your financial capacity and long-term goals. Remember to factor in additional costs like late payment fees and the potential impact of interest capitalization when making your final assessment.

Pros and Cons of Longer Repayment Terms

Choosing a student loan repayment plan involves carefully weighing various factors. One crucial aspect is the length of the repayment term. Longer repayment terms, while seemingly offering immediate relief, come with their own set of advantages and disadvantages.

One significant pro of longer repayment terms is the reduced monthly payment. This lower payment can make budgeting easier, especially for borrowers with limited post-graduation income. It can provide more financial flexibility to cover other essential expenses like rent, utilities, and transportation. This reduced financial strain can improve overall financial well-being and reduce stress.

However, the apparent benefit of smaller monthly payments comes with a considerable con: increased total interest paid. Longer repayment terms translate to more time accruing interest on the principal loan amount. This means you will end up paying significantly more over the life of the loan than if you opted for a shorter repayment period. This increased interest cost can dramatically increase the overall cost of your education.

Another factor to consider is the impact on your credit score. While a lower monthly payment may seem attractive, consistently making smaller payments over a longer period might not showcase your creditworthiness as effectively as higher payments made over a shorter period. This could potentially impact your ability to secure other loans or credit in the future.

Ultimately, the decision of whether to choose a longer repayment term hinges on your individual financial situation and risk tolerance. Carefully assess your income, expenses, and long-term financial goals before committing to a specific repayment plan. Consider consulting with a financial advisor to determine the best course of action.

What to Do If Your Situation Changes

Life is unpredictable, and your financial situation can change significantly after you’ve chosen a student loan repayment plan. Unexpected job loss, a decrease in income, or even a major life event like starting a family can impact your ability to make your monthly payments.

It’s crucial to understand your options if your circumstances alter. Most loan servicers offer programs to help borrowers facing hardship. Contacting your loan servicer immediately is the most important first step. They can explain the various options available to you, such as deferment, forbearance, or income-driven repayment (IDR) plans.

Deferment temporarily postpones your payments, often requiring documentation of hardship. Forbearance also pauses or reduces payments, but it may accrue interest. IDR plans calculate your monthly payments based on your income and family size, potentially leading to lower monthly obligations.

Before making any decisions, carefully review the terms and conditions of each option. Understand the implications for your long-term repayment timeline and total interest paid. Seeking advice from a financial advisor can also be beneficial to determine the best course of action based on your unique situation.

Remember, proactive communication with your loan servicer is key to navigating unexpected changes. Ignoring the problem will only worsen your financial situation. By taking prompt action, you can explore options that provide financial relief and help you manage your student loan debt effectively.