Navigating the complexities of student loan repayment can feel overwhelming, but understanding your student loan servicer is a crucial first step towards a smoother and more manageable process. Your servicer is the company responsible for handling your student loan payments, providing customer service, and assisting you with various loan management options. This seemingly simple relationship holds significant weight in determining your repayment plan, interest rates, and overall financial well-being. Ignoring your servicer’s role can lead to missed payments, accrued penalties, and potentially even default on your loans.

This article will delve into the importance of knowing your student loan servicer, clarifying their responsibilities and highlighting how their actions directly impact your student loan debt. We’ll explore how to locate your servicer, understand their communication methods, and effectively leverage their resources to navigate potential challenges. Whether you’re facing student loan forgiveness, exploring repayment plans like income-driven repayment (IDR), or simply seeking clarity on your account details, grasping the role of your student loan servicer is paramount to successfully managing your student loan debt and achieving long-term financial stability.

What Is a Student Loan Servicer?

A student loan servicer is a company that’s contracted by the U.S. Department of Education or a private lender to manage your student loans on their behalf. They don’t actually lend you the money; instead, they act as an intermediary between you and the lender.

Your servicer handles many crucial aspects of your loan repayment, including: processing payments, answering your questions about your loan, managing deferments and forbearances, and providing information about your repayment options. Think of them as your main point of contact for everything related to your student loan accounts.

It’s important to understand that you may have multiple servicers if you have loans from different lenders or loan programs. Each servicer will manage the loans they are responsible for independently. Keeping track of who services which loans is a vital part of effective loan management.

The role of the servicer extends beyond just collecting payments. They are also responsible for communicating important information regarding your account, such as changes to your repayment plan, interest rate adjustments, and any potential issues with your account. Maintaining good communication with your servicer is essential to ensuring your loans are handled correctly and efficiently.

In short, your student loan servicer is a critical component of your loan repayment journey. Understanding their function and keeping track of their contact information is crucial for successful repayment and avoiding potential complications.

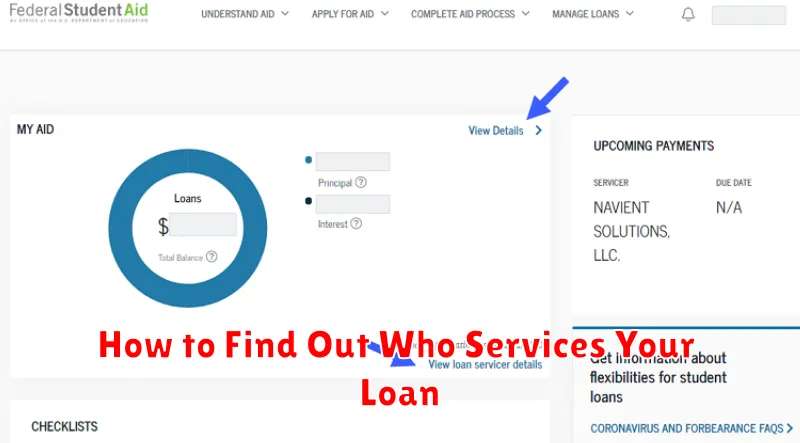

How to Find Out Who Services Your Loan

Knowing who your student loan servicer is a crucial first step in effectively managing your student loan debt. Your servicer is the company responsible for collecting your payments, answering your questions, and managing your account. Finding this information is usually straightforward, but the exact method depends on where you obtained your loan.

For federal student loans, the most reliable source is the National Student Loan Data System (NSLDS). The NSLDS is a centralized database maintained by the U.S. Department of Education. Accessing your NSLDS account will clearly display your loan servicer’s name and contact information. You’ll need your Federal Student Aid (FSA) ID to log in.

If your loans are privately held, the process is slightly different. Your loan servicer’s details should be included on your monthly statement, or on any communication from your lender. Alternatively, you can contact the lender directly that provided the loan. They will be able to tell you which company handles servicing for your specific loan.

Keep your loan documents readily available. Your original loan documents should clearly state the name of your servicer. If you have misplaced these documents, don’t hesitate to reach out to your lender or servicer. Remember to always verify any information you receive from a third party source to protect your personal data.

Understanding your loan servicer’s contact information—phone number, mailing address, and website—is essential for efficient communication. This ensures you can easily address any questions or concerns related to your loan repayment, and makes it easier to handle changes to your repayment plan or other account updates.

What They’re Responsible For

Your student loan servicer plays a crucial role in managing your federal student loans. Their primary responsibility is to process your payments. This includes receiving your payments, applying them to your account, and maintaining accurate records of your payment history.

Beyond payment processing, servicers are responsible for providing customer service. They answer your questions about your loan, explain your repayment options, and help you navigate any issues that may arise. This includes assisting with things like deferment or forbearance requests.

Servicers also handle important communications regarding your loan. They will send you statements, notices about changes to your repayment plan, and reminders about upcoming payments. It is crucial to keep your contact information updated with your servicer to ensure you receive these important communications.

Another key responsibility is managing your repayment plan. They will help you choose a plan that fits your budget and financial situation, and will adjust your payments as needed, if eligible, based on your income or circumstances. They’ll also help you understand the terms and conditions of your loan.

Finally, servicers are responsible for managing your loan account throughout its entire lifecycle. This includes keeping your account information up-to-date, ensuring accurate reporting to credit bureaus, and assisting with loan consolidation or forgiveness programs where applicable. They are your primary point of contact for all things related to your federal student loan.

Why Communication Is Critical

Effective communication with your student loan servicer is paramount to successfully managing your student loans. Misunderstandings can lead to missed payments, accruing interest, and ultimately, damage to your credit score. Open and consistent communication ensures you stay informed about your loan status, repayment options, and any potential issues.

Understanding your servicer’s communication methods is key. This includes knowing how they will contact you (phone, email, mail) and understanding the information they are likely to send. Familiarizing yourself with their preferred methods of contact allows you to respond promptly and avoid missed deadlines or important updates. Proactive communication, such as regularly checking your account online and contacting your servicer with questions, is equally vital.

Clear and concise communication on your part is essential. When contacting your servicer, clearly state your purpose and provide all necessary information. This may include your loan ID number, the specific issue you are addressing, and any relevant documentation. The more organized and detailed your communication, the quicker and more effective their response will likely be. Furthermore, keeping detailed records of all communication (dates, methods, and content of interactions) can be crucial in resolving any future disputes.

In short, proactive and effective communication forms the bedrock of a positive relationship with your student loan servicer. It is a fundamental aspect of responsible loan management and contributes significantly to your overall financial well-being.

How to Change Servicers If Needed

While you generally cannot choose your student loan servicer, there are circumstances where a change may occur. Your servicer might be replaced by another company due to contractual changes or government decisions. You will typically receive notification from your servicer and the new servicer well in advance of any transfer.

If you experience significant problems with your current servicer, such as difficulty contacting them, inaccurate billing, or failure to process payments correctly, you can contact the Department of Education (ED). The ED oversees the student loan servicing process and can investigate complaints and potentially facilitate a transfer to a different servicer if justified.

The process of changing servicers due to issues is not necessarily immediate. You will need to provide the ED with detailed documentation supporting your complaint. This could include copies of correspondence, payment confirmations, and other evidence to demonstrate the problems you’ve encountered. Be prepared for a thorough investigation by the ED.

Remember that changing servicers due to issues is not guaranteed. The ED will assess your situation and determine if the circumstances warrant a transfer. It’s crucial to maintain organized records of all your interactions with your servicer and the ED to support your case.

Alternatively, if you are consolidating your loans, you may have a choice of servicers through the consolidation program. This offers a potential avenue for selecting a servicer that better meets your needs, but it’s important to carefully compare options before making a decision.

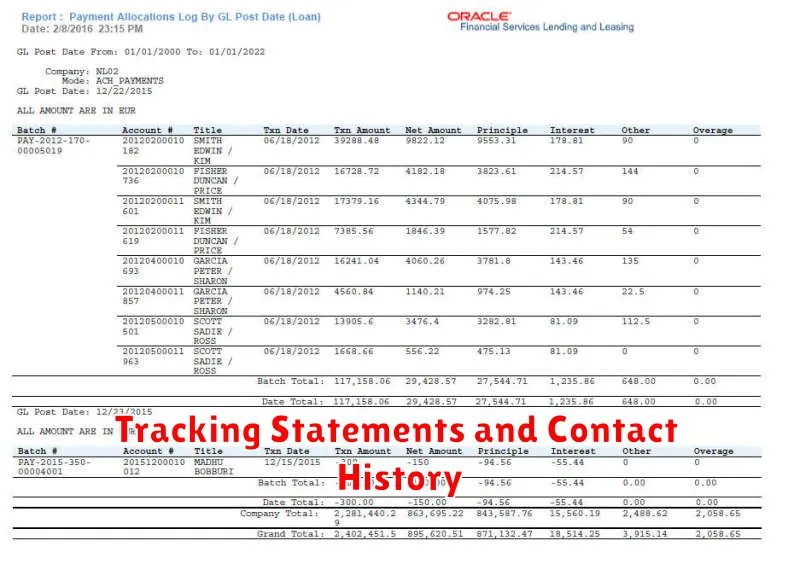

Tracking Statements and Contact History

Understanding your student loan servicer’s communication methods is crucial for successful repayment. Tracking your monthly statements is paramount; these statements provide details on your loan balance, payment due date, and any applicable interest accrual. Maintaining organized records of these statements allows you to easily monitor your progress and identify any discrepancies.

Equally important is keeping a record of your contact history with your servicer. This includes notes on all phone calls, emails, and letters exchanged. Documenting the date, time, subject of the communication, and the name of the representative you spoke with can prove invaluable should any issues arise. This detailed record can be a critical resource in resolving disputes or clarifying account information.

Consider using a dedicated system for organizing your statements and contact history. This could involve a physical filing system, a digital folder on your computer, or a dedicated note-taking app. The key is to have a reliable method for accessing this information quickly and easily whenever needed. Properly maintaining this documentation demonstrates proactive engagement with your loan repayment, a vital aspect of responsible financial management.

Your servicer’s website often provides online access to statements and communication logs, simplifying the tracking process. Familiarize yourself with these online tools; they can significantly streamline the management of your student loan account.